sacramento property tax rate 2020

The California state sales tax rate is currently 6. The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year.

What Living In Sacramento Is Like Is Moving To Sacramento A Good Idea

The Sacramento County sales tax rate is 025.

. The table above shows the fifty states and the District of Columbia ranked from highest to lowest by annual property taxes as a percentage of the. This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. This is the total of state and county sales tax rates.

The combined tax rate of 875 consists of the California sales tax rate at 6 the Sacramento County sales tax rate at 025. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. 1-916-274-3350 FAX 1-916-285-0134 wwwboecagov December 27 2019.

Sacramento county tax rate area reference by primary tax rate area. In comparison some Los Angeles residents have tax rates around 119302. Documents presented by 300 pm.

Learn all about Sacramento real estate tax. Total tax rate Property tax. The minimum combined 2022 sales tax rate for Sacramento California is.

Some property owners in San Diego City have a 117461 tax rate while some in Chula Vista have a rate of 114221. What is the Sacramento County tax rate. This is mostly due to the general tax levy of 1.

New Jersey has the highest effective rate on owner-occupied property at 221 percent followed closely by Illinois 205 percent and New Hampshire 203 percent. They can be reached Monday 100 pm - 400 pm and Tuesday - Friday 830 am to 400 pm at 916 808-1202. This tax has existed since 1978.

Sacramento County has property tax rates that are similar to most counties in California. For more information view the Parcel Viewer page. This tax is charged on all NON-Exempt real property transfers that take place in the City limits.

The California sales tax rate is currently. Did South Dakota v. Property information and maps are available for review using the Parcel Viewer Application.

Enter an Address to Receive a Complete Property Report with Tax Assessments More. The median property tax on a 32420000 house is 340410 in the United States. Online videos and Live Webinars are available in lieu of in-person classes.

Please contact the local office nearest you. Ad Search County Records in Your State to Find the Property Tax on Any Address. Permits and Taxes facilitates the collection of this fee.

The median property tax on a 32420000 house is 220456 in Sacramento County. Two Family - 2 Single Family Units. Primary tax rate area taxing entity page 00 utility unitary and pipeline 1 01 isleton city of 1 03 sacramento city of 1 04 folsom city of 24 05 galt city of 26 06 citrus heights city of 29.

Sacramento County to apportion and allocate property tax revenues for the period of July 1 2016 through June 30 2019. Two Family - 2 Single Family Units. Businesses impacted by the pandemic please visit our COVID-19 page.

Finance 700 H Street Room 1710 First Floor Sacramento CA 95814 916-874-6622 or e-mail Additional Information. The sales tax rate for Sacramento County in the state of California as on 1st January 2020 varies from 775 to 875 depending upon in which city you are computing the sales tax. Sacramento county 2019-2020 compilation of tax rates by code area code area 03-017 code area 03-018 code area 03-019 county wide 1 10000 county wide 1 10000 county wide 1 10000 los rios coll gob 00232 los rios coll gob 00232 los rios coll gob 00232 sacto unified gob 01139 sacto unified gob 01139 sacto unified gob 01139.

Property taxes are a one-percent tax on a propertys assessed value under California law After the deduction of property tax exemptions for homeowners disabled veterans and charitable organizations the Countys total net assessed value for 2020-21 is over 180 billion. 3636 American River Drive Suite 200 M ap. The median property tax also known as real estate tax in Sacramento County is 220400 per year based on a median home value of 32420000 and a median effective property tax rate of 068 of property value.

View the E-Prop-Tax page for more information. Tax Collection and Licensing. CDTFA public counters are now open for scheduling of in-person video or phone appointments.

The County sales tax rate is. Real Property Transfer Tax - City of. Monday through Friday excluding holidays are recorded the same day.

Sacramento County to apportion and allocate property tax revenues for the period of July 1 2016 through June 30 2019. The Sacramento sales tax rate is. Property tax revenues Senate Bill 418 which requires the State Controller.

Others like New Jersey and Illinois impose high property taxes alongside high rates in the other major tax categories. For purchase information please see our Fee Schedule web page or contact the Assessors Office public counter at 916 875-0700. Whether you are already a resident or just considering moving to Sacramento to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

Sales Tax for Sacramento CA. Two Family - 2 Single Family Units. And the development of the tax rate area TRA annual tax increment ATI apportionment factors which determine the.

Two Family - 2 Single Family Units. For questions about filing extensions tax relief and more call. Sacramento County California sales tax rate details The minimum combined 2021 sales tax rate for Sacramento County California is 775.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property taxes collected on. The property tax rate in the county is 078. Hawaii sits on the other end of the spectrum with the lowest.

This is the total of state county and city sales tax rates. The median property tax on a 32420000 house is 239908 in California. Two Family - 2 Single Family Units.

Sacramento County collects relatively high property taxes and is ranked in the top half of all counties in the United States.

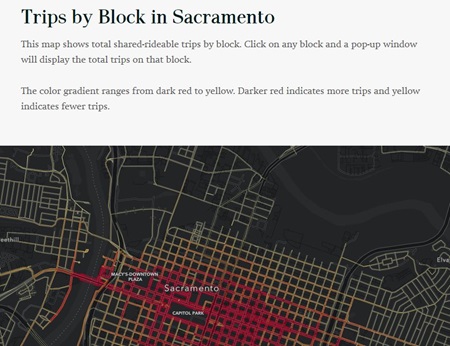

Shared Rideables City Of Sacramento

3745 Las Pasas Way Sacramento Ca 95864 Mls 19036325 Zillow Home Loans Home Inspector Zillow

Sacramento County Ca Property Tax Search And Records Propertyshark

Map Of City Limits City Of Sacramento

Sacramento County Ca Property Tax Search And Records Propertyshark

Services Rates City Of Sacramento

Untitled Design Presentation 16 9 Mortgage Payment Calculator Adjustable Rate Mortgage Mortgage Payment

Free Verification Employment Letter Template Excel Letter Template Word Lettering Printable Letter Templates

Sacramento County Ca Property Tax Search And Records Propertyshark

Understanding Inequitable Taxes On Commercial Properties And Prop 15 California Budget And Policy Center

Best Cpa In Carson County Nv Business Valuation Nevada Cpa

Sacramento Ca Weather Forecast And Conditions The Weather Channel Weather Com The Weather Channel Weather Forecast Weather

Sacramento County Property Tax Anderson Business Advisors

Sacramento County Ca Property Tax Search And Records Propertyshark

Why November Could Mean The End Of Prop 13 And An 11 4 Billion Increase In Property Taxes For Commercial Owners And Tenants Sacramento Business Journal

Second Installment Of Property Taxes Due 4 11

What Will Happen If You Can T File Your Tax On April 15 Tax Day Filing Taxes Tax Deadline

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop